Industry news: Toothpaste ingredients and efficacy play a 'combination of fists', refined category search heat rise

Industry news: Toothpaste ingredients and efficacy play a 'combination of fists', refined category search heat rise

In recent years, on the one hand, consumers have paid more and more attention to oral health, and their awareness of oral care has gradually increased. On the other hand, oral care products are also constantly innovating and upgrading, and oral care is developing in the direction of standardization, specialization, diversification, and refinement.Toothpaste remains the mainstream category in the online oral care product market, showing strong development momentum.

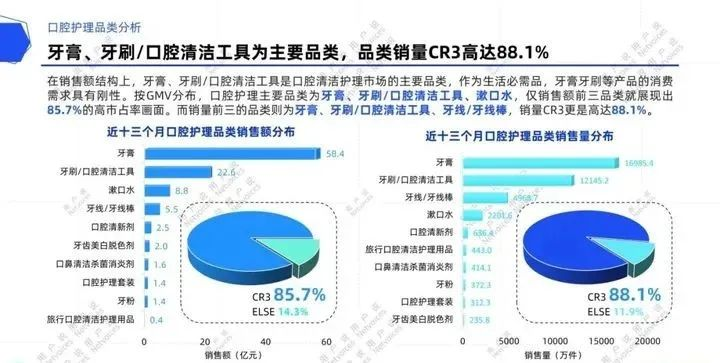

Toothpaste ingredients and efficacy play a 'combination punch' data show that from October 2022 to September 2023, the sales trend of oral care categories on Tmall Taobao platform declined, with GMV (gross merchandise transactions) of 9.622 billion yuan, a year-on-year decrease of 10.68%. Sales volume was 346 million pieces, a slight increase of 3.3% year-on-year. Looking at the distribution structure of sub-categories, toothpaste contributed 58.4% of sales, leaving other categories such as toothbrushes/oral cleaning tools and mouthwash far behind. According to statistics, from September 1, 2022 to September 30, 2023, the sales volume of toothpaste on Tmall Taobao reached 169.854 million pieces.

The current competition in the toothpaste category is mainly focused on ingredients. In order to further highlight product differentiation, major toothpaste brands will also launch patented ingredients. As the consumer market continues to upgrade and consumer demand becomes increasingly diverse, the toothpaste industry is also constantly segmented. In addition to the basic cleaning effect, many toothpastes also add various ingredients, claiming to have whitening, anti-inflammatory, anti-allergic and other effects. All major brands will use ingredients such as probiotics, high-purity baking soda, and anti-glycolytic enzymes as selling points of their products. While emphasizing efficacy, the industry's sensitivity to policies should also be improved.

The 'Regulations on the Supervision and Administration of Cosmetics' that was previously implemented in early 2021 clearly included toothpaste under supervision with reference to ordinary cosmetics for the first time. There are only three categories of effective toothpaste recognized by the National Health Commission and with national standards: anti-caries, anti-allergic, and anti-inflammatory, which are relatively affordable. Those ‘exorbitantly expensive toothpastes’ that claim to have other effects have no national standards.Those 'exorbitantly expensive toothpastes' that claim to have other effects have no national standards. This means that even if there is a certain ingredient in the 'high-priced toothpaste', it may not be able to achieve various magical effects. On December 1, the 'Toothpaste Supervision and Management Measures' formulated by the State Administration for Market Regulation and the State Food and Drug Administration came into effect.

The 'Measures' not only clearly define the boundaries of toothpaste, but also strictly limit the terms used to claim the efficacy of toothpaste products such as preventing caries, inhibiting dental plaque, fighting dentin sensitivity, and alleviating gum problems. It is prohibited to label content that states that it has 'express or implied medical effects' or is false or misleading, and clearly stipulates that toothpaste filers are responsible for the quality, safety and efficacy claims of toothpaste to curb the occurrence of illegal toothpaste claims. The implementation of various regulatory regulations has also drawn red lines for toothpaste companies in production and claims.

Different age groups have different preferences for oral care products. Data show that the age structure of users on Douyin and Xiaohongshu platforms is relatively rich, with young and middle-aged people being the main consumer groups of the platforms. Among them, users aged 18 to 24 account for the highest proportion on the Xiaohongshu platform, accounting for 30% to 40%. On the Douyin platform, users aged 31 to 40 are mainly users, accounting for the same 30% to 40%.

Judging from user preferences on different platforms, Xiaohongshu’s young users under the age of 24 prefer domestic brands, while Douyin’s users over the age of 30 are loyal fans of established domestic products. Consumer groups of different age groups have significantly different oral care needs. For young consumers, more diversified oral care products can meet their needs for freshness and personalization. For middle-aged and elderly consumers, it is necessary to target their oral care needs that focus on practicality and comfort.

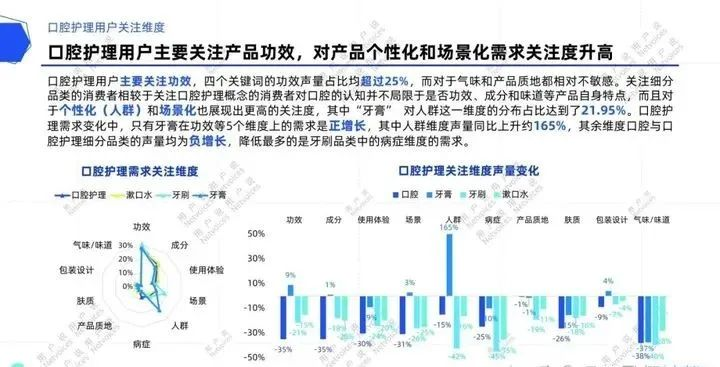

The data subdivides oral care demand concerns into 10 dimensions: 'Efficacy', 'Ingredients', 'Usage experience', 'Scenes', 'Population', 'Diseases', 'Product texture', 'Skin quality', 'Packaging design' and 'Smell/taste'. Taking the time period from October 1, 2022 to September 30, 2023, through data research on keyword volume, the keyword 'toothpaste' has increased by 165% year-on-year in the 'crowd' dimension. And there is also positive growth in the four dimensions of 'efficacy', 'ingredients', 'scenes' and 'packaging design'. Compared with other oral care keywords that have negative growth in all dimensions, 'toothpaste' is the only keyword that maintains a positive growth trend in some dimensions. From the perspective of dimensional distribution, 'toothpaste' accounts for 21.95% of the volume in the 'crowd' dimension. It can be seen that consumers are paying more and more attention to the personalization of toothpaste for segmented groups.

The demand for personalized and scenario-based oral care products is growing. This is partly because consumers want to find oral care products that suit them, rather than accepting a universal solution. On the other hand, on the supply side, scientific and technological progress allows manufacturers to understand consumers’ oral pH, saliva secretion, etc. through technical means, so as to customize suitable oral care products for them. At the same time, modern people’s lifestyles and eating habits are very different from those in the past. The prevalence of late-night snack culture and frequent drinking of coffee and carbonated drinks have all given rise to consumer groups’ refined demand for oral care products. Currently, the consumer society has entered the era of experience economy. In the context of the experience economy, increasingly segmented consumer demands have prompted continuous iteration of oral care products. In order to promote the continued good progress of the industry, the PCE Oral Products Exhibition will be held at the Guangzhou Nanfeng International Convention and Exhibition Center from March 5-7, 2024. At that time, many brands will debut with new products, and many professionals will be present to help consumers clean their mouths more efficiently and establish an oral care rhythm that suits them.