Industry News: Rapid Development in Subcategories Such as Children's Oral Care and Water Flossers

Industry News: Rapid Development in Subcategories Such as Children's Oral Care and Water Flossers

With the continuous development of China's economy in recent years and the sustained improvement in living standards, people's dietary habits have gradually changed. As people indulge in sweets, carbonated drinks, and other products, oral health issues have become increasingly severe. Against this backdrop, oral care, as a means to prevent oral diseases and avoid bacterial infections, has seen growing demand, driving the rapid development of China's oral care industry.

Looking at the market structure, basic oral care accounts for the highest proportion at 61.6%, electric oral care at 26.5%, and professional oral care at 11.9%.

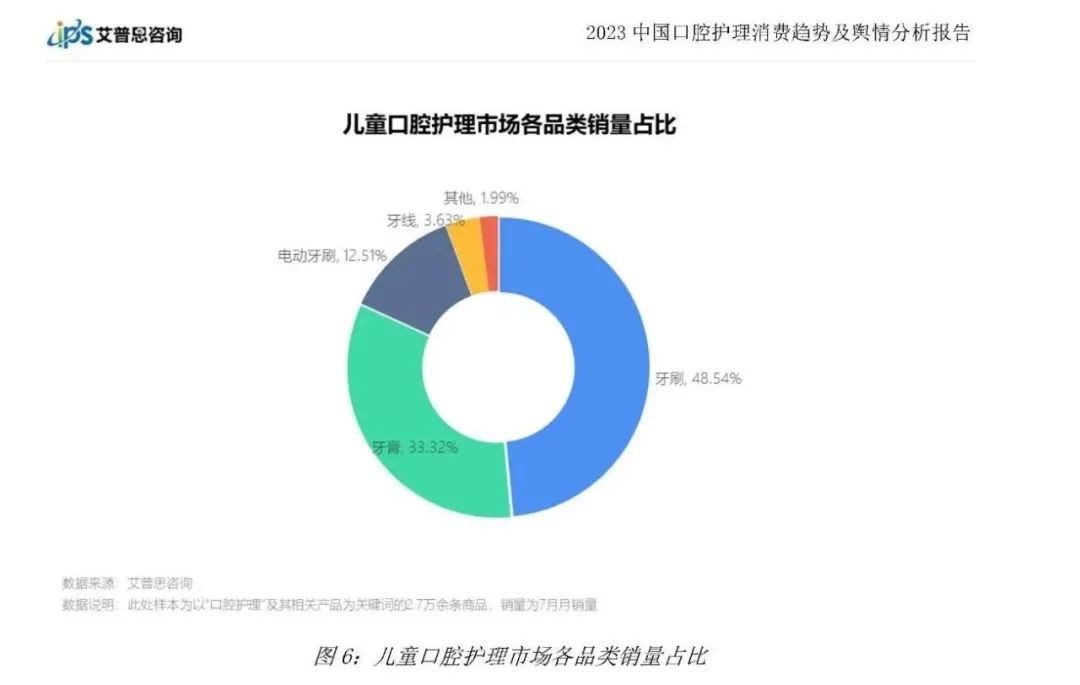

Children's oral care is one of the important subcategories of oral care.

In recent years, with the support of national policies and the growing awareness among parents to protect their children's oral health, the sales scale of children's oral care products in China has grown rapidly. Data shows that in 2023, the sales scale of children's oral care products in China reached 5.4 billion yuan, a year-on-year increase of 12.5%.

Regarding penetration rate, thanks to support policies aimed at regulating the caries rate in 12-year-olds, more parents have realized the benefits of oral care products designed specifically for children. For example, the cute ergonomic design makes it comfortable for children's small hands, and fruit-flavored toothpaste helps develop the habit of brushing teeth.

The 'China Children's Oral Health Development White Paper' shows that the market growth is currently dominated by offline channels. As the degree of specialization increases, more people enter professional and online channels, in which process emerging brands play a very important role. For instance, according to Douyin e-commerce data, from January to July 2023, the growth rate of baby and toddler toothpaste was close to 260%.

Many brands that primarily focus on adult toothpaste have extended into children's toothpaste, but with insufficient emphasis, 'The products children need are very different from what adults need.' In recent years, emerging independent brands have shown more focus on developing products, with specialized teams searching for channels to expand the market.

Taking MOMPICK as an example, compared to traditional children's toothpaste, which does not contain fluoride or only adds sodium fluoride, MOMPICK first introduced German organic Olaflur, which is better in extensibility and diffusibility. Accordingly, the raw material cost of organic Olaflur is 700 times that of traditional sodium fluoride.

It is reported that in 2023, MOMPICK's children's toothpaste sales scale increased by 706% year-on-year, and its Olaflur age-specific toothpaste has a market share of more than 30% in multiple channels. In 2024, MOMPICK's toothpaste offline sales terminals will exceed 50,000.

The Rapid Rise of the Water Flosser Market

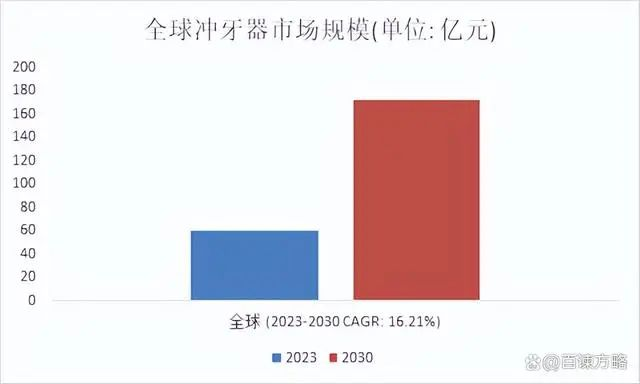

With the upgrade of Chinese consumers' habits, more emphasis is placed on oral health, and people are willing to pay more for it. Under the new retail environment, the perfection of online sales channels, such as Taobao, Tmall, JD, etc., has also greatly promoted the growth in sales volume of water flossers.

The global water flosser market size shows a steady expansion trend, with sales reaching 6.04 billion yuan in 2023 and expected to reach 17.29 billion yuan by 2030, with a compound annual growth rate (CAGR) of 16.21% from 2024 to 2030. North America is the largest market globally, accounting for about 50.07% of the market share in 2023, followed by the European market, accounting for about 20.17%.

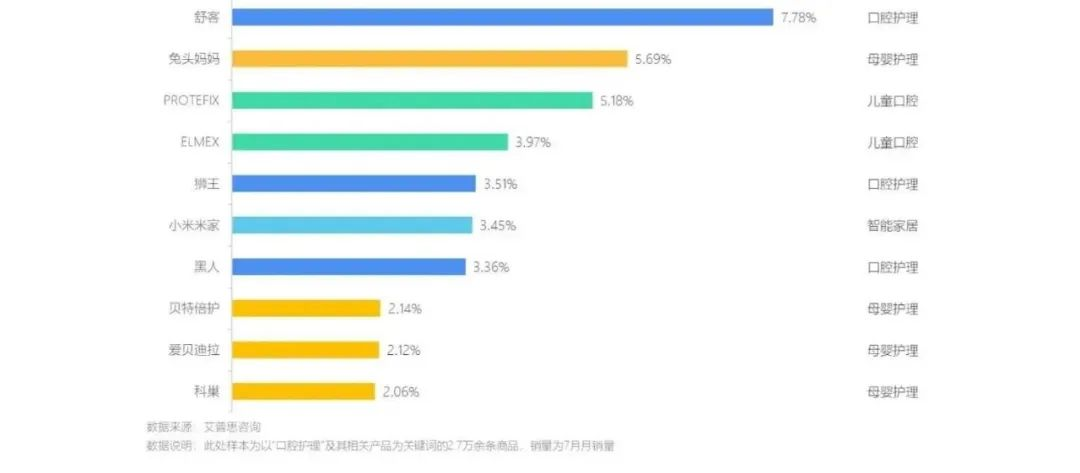

With the rapid rise of the water flosser market, the number of sales brands of domestic water flossers has also rapidly expanded, including comprehensive home appliance brands and emerging personal care small appliance companies, as well as consumer electronics brands such as Xiaomi and Huawei entering this field.

Data released by the China Oral Cleaning Care Products Industry Association shows that in the first quarter of 2023, the top five brands in the water flosser industry were Bixdo, Bayer, Usmile, MIJIA, and Panasonic, with their online retail shares being 15.1%, 12.1%, 11.6%, 8.4%, and 8% respectively. Moreover, the market share of the top ten brands in the water flosser industry exceeds 70%, indicating a high concentration of industry brands.

The water flosser market is highly competitive, with main suppliers including Waterpik, Panasonic, Procter & Gamble, Philips, and Conair. The competition between international brands and domestic brands is becoming increasingly fierce. Domestic brands are continuously optimizing and iterating in quality, experience, design, after-sales, and service, making their overall reputation and strength close to or even matching that of international big names.

The Chinese oral care industry is in a stage of high-speed growth. The government has successively introduced multiple policies to support the development of China's oral care industry, providing a favorable policy environment for the industry. Oral care products will be further segmented for different consumer groups. For example, young female consumers will pay more attention to teeth whitening and fresh breath; children need softer toothbrush materials and more attractive toothpaste flavors to help develop better oral care habits; while some other consumers desire products for desensitizing teeth, cleaning tongue coating, and other special needs. Based on the specific needs of different consumer groups, the diversification and specialization of oral care products have become one of the main development trends in the future oral care market.

In the absence of significant changes in the market consumption environment, categories such as toothpaste/powder, electric toothbrushes, and toothbrushes continue to grow, and major brands engage in more intense competition in both the stock market and niche segments. The intensification of industry competition and the implementation of related regulations prompt companies to innovate and explore paths to high-quality development. The Guangzhou International Oral Care Expo (PCE Oral Care Expo), under the leadership of the China Oral Care Industry Association, brings together many elite experts in the industry to constantly explore new trends.

As the first professional industry exhibition of the year in 2024, the exhibition relies on the rich innovative resources and geographical advantages of the South China region, gathering new and trendy products and cutting-edge technology to continuously 'activate the oral health industry' and provide a one-stop service platform for professional and efficient procurement selection and business exchange in the industry.

To promote companies to develop the global market, the domestic exhibition of PCE Oral Care Expo will be held on March 5-7, 2024 at the Nanfung International Convention and Exhibition Center in Guangzhou, and on August 7-9, 2024 at the Shanghai New International Expo Center. The overseas exhibitions will be held on June 4-6, 2024 at the Jakarta International Expo in Indonesia, and on December 17-19, 2024 at the Dubai World Trade Center in the United Arab Emirates. Initiating a linkage strategy between core regions at home and abroad, comprehensively expanding the PCE brand series exhibition map, integrating domestic and international dual circulation, and jointly building a new world for industry development.